Brace yourself for an economic hurricane.

That was the advice conveyed by JPMorgan Chase CEO Jamie Dimon earlier this month at a financial conference. His sentiment was echoed just a few days later by Tesla CEO Elon Musk, who told his executives that he has a “super bad feeling” about the economy and plans to cut the company’s staff by 10%.

They’re certainly not the only ones concerned about the future direction of the U.S. economy. More than 80% of Americans now believe that the U.S. will fall into a recession before the end of this year. The University of Michigan’s closely-watched Consumer Sentiment Index is also flashing warning signals, falling to a level not seen in over 40 years. Even economists have grown more pessimistic, pegging the odds of a recession in the next year at 30% (twice as high as they predicted just a few months ago).

Now, in addition to worker shortages, supply chain disruptions and inflationary pressures, business leaders are starting to grapple with the prospect of an economic recession — one that could potentially be deep and sustained. Companies are girding for a downturn, exploring ways to insulate themselves from the worst effects of a contracting economy.

To solve for that challenge, executives would be wise to look at the past and consider what strategies helped businesses to not just survive the last multi-year recession, but thrive in its aftermath. That’s precisely what Watermark Consulting sought to do.

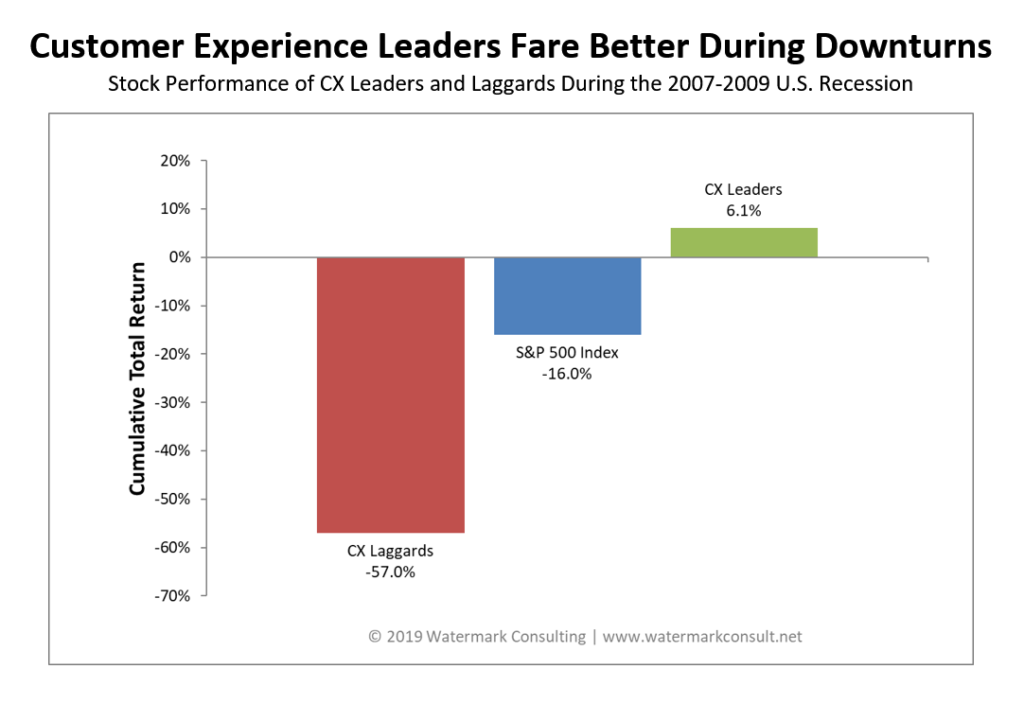

For over a decade, Watermark has studied the connection between customer experience (CX) and shareholder return (based on third-party consumer feedback surveys and public company stock performance data). The resulting Customer Experience ROI Study has since become one of the most widely-cited analyses of its kind. And while that study has vividly illustrated how CX-leading companies outperform their peers over the long-term, we wondered what the data would indicate for just the period of the last prolonged U.S. recession (2007-2009). The results were striking:

While CX-leading companies weren’t immune from the effects of the 2007-2009 Great Recession, they clearly fared better than other firms. Whereas the broader market and the CX-lagging companies lost significant market value during the contraction, the CX-leading ones actually notched positive shareholder returns.

It’s been well documented through many studies (not just Watermark’s) that a great customer experience fuels financial performance: It helps raise revenues, since loyal customers stick around longer, they tend to be less price sensitive, they entertain ideas for other products and services, and they refer entirely new customers to your business. In addition, a great customer experience helps control, if not reduce expenses, as less needs to be spent on new business acquisition (due to all those referrals and repeat business), and the cost to serve customers declines as fewer complaints put less stress on a company’s operating infrastructure.

But there are additional conclusions to be drawn when looking at Watermark’s CX ROI data for the Great Recession — foremost among them, that the quality of a company’s customer experience does indeed influence its ability to successfully weather an economic downturn.

“The quality of a company’s customer experience does indeed influence its ability to successfully weather an economic downturn.”

CX-leading firms appear to be cushioned from the most severe impacts of a recession, and they seem to bounce back faster when a recovery takes hold. That’s likely a consequence of how customer behavior is shaped by great product and service experiences: Businesses offering such experiences become one of the last places people cut back (or seek less expensive alternatives), and one of the first places to which they return when their budgets become less constrained.

When faced with the prospect of a recession, many business leaders’ knee-jerk reaction is to cut expenses — curtail travel, freeze hiring, postpone investments, etc. But what the Watermark analysis suggests is that if cost-cutting starts to undermine the quality of a company’s customer experience, then it could very well dim the organization’s post-recession prospects rather than elevate them.

So how can a CEO or business owner capitalize on customer experience to shield their organization from the worst effects of the next recession? Here are three strategies to employ:

- Give customers a reason to return. We’re not in a recession yet, and both consumer and business spending remains strong. That means companies continue to have many opportunities to shape customer impressions. Take advantage of that before people start to rein in their spending. Do what you can to polish your customer experience now and give people a reason to keep coming back in the future.

- Cut costs by preempting avoidable customer inquiries. It’s actually possible to cut costs while enhancing the customer experience. The key is to focus on upstream improvements that eliminate downstream, cost-inflating customer inquiries. Examples include better product assembly instructions, clearer and more comprehensible invoices, more seamless product return procedures, and even just better expectation-setting at point-of-sale. These types of upstream enhancements translate into a better customer experience that can be delivered at a more competitive cost.

- Reexamine what’s relevant to your customer. As economic conditions change, so too may your customer’s needs, wants, fears, and aspirations. Product features and/or services that were important to them yesterday may not be as important to them today. In addition, new customer requirements may emerge that present an opportunity to engage customers in a different and more compelling way. (Carmaker Hyundai did this during the Great Recession with its Job Loss Assurance program, to assuage consumers’ fears about getting laid off after buying a car. It was an experience enhancement that drove a 40% increase in Hyundai’s North American market share.)

It’s not possible to completely insulate one’s business from the effects of an economic downturn. However, what the Watermark study illustrates is that customer experience differentiation can help shield an organization from the worst impacts of a contraction, as well as position it for success when conditions improve. Because the lesson from CX-leading firms is clear: Deliver an experience that customers absolutely love, and they’ll reward you with their business — in both good times and bad.

[A version of this article originally appeared on Forbes.com.]

Jon Picoult is founder of Watermark Consulting, a customer experience advisory firm that helps companies impress customers and inspire employees, creating raving fans that drive business growth. Author of “FROM IMPRESSED TO OBSESSED: 12 Principles for Turning Customers and Employees into Lifelong Fans,” Picoult is an acclaimed speaker, and advisor to some of world’s foremost brands. Follow Jon on Twitter or Instagram, or subscribe to his monthly eNewsletter.